All Categories

Featured

Table of Contents

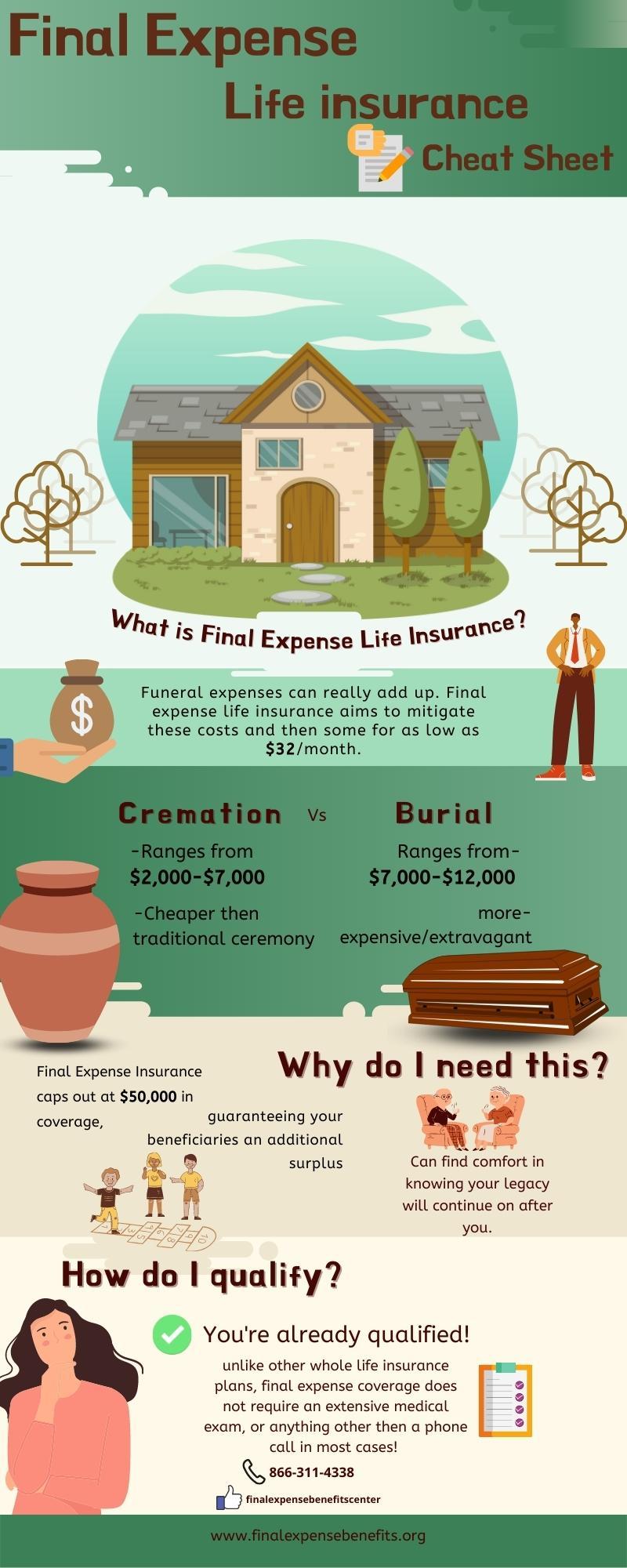

While lots of life insurance products require a clinical test, final expense insurance policy does not. When applying for final expense insurance, all you have to do is answer numerous questions concerning your wellness.

If you're older and not in the finest wellness, you might notice greater premiums for last cost insurance. Before you commit to a final cost insurance plan, consider these aspects: Are you simply looking to cover your funeral and burial expenditures? If so, final expense insurance is likely an excellent fit.

If you would certainly such as enough insurance coverage without damaging the bank, final cost insurance coverage might be rewarding. If you're not in great health, you may intend to miss the medical examination to get life insurance protection. In this case, it may be wise to take into consideration last expense insurance. Final cost insurance can be an excellent way to assist protect your loved ones with a tiny payment upon your fatality.

Best Value Funeral Insurance

Plan ends up being convertible to a whole life plan in between the ages of 22 to 25. A handful of factors affect just how much last expenditure life insurance coverage you genuinely need.

They can be utilized on anything and are created to aid the recipients prevent a financial situation when an enjoyed one passes. Funds are frequently used to cover funeral expenses, clinical bills, repaying a mortgage, auto loans, or even made use of as a savings for a brand-new home. If you have adequate savings to cover your end-of-life expenses, then you may not require last cost insurance.

On top of that, if you've been not able to get larger life insurance policy policies due to age or medical conditions, a last expense plan may be an affordable option that reduces the problem put on your family members when you pass. Yes. Last cost life insurance policy is not the only method to cover your end-of-life costs.

These normally provide greater protection amounts and can safeguard your family's way of life along with cover your last costs. Connected: Whole life insurance policy for seniors.

They are usually provided to applicants with several wellness conditions or if the applicant is taking specific prescriptions. If the insured passes throughout this duration, the beneficiary will normally receive all of the premiums paid into the plan plus a little additional percentage. One more last expenditure choice offered by some life insurance firms are 10-year or 20-year plans that provide candidates the alternative of paying their plan completely within a specific timespan.

Final Expense Insurance Quotes

The most crucial point you can do is address questions truthfully when obtaining end-of-life insurance policy. Anything you withhold or conceal can create your benefit to be denied when your family requires it most. Some individuals think that because a lot of last expense plans do not require a medical examination they can lie regarding their health and the insurer will certainly never ever understand.

Share your final dreams with them also (what flowers you may desire, what flows you desire checked out, tracks you want played, and so on). Recording these in advance of time will conserve your loved ones a great deal of stress and anxiety and will avoid them from attempting to presume what you wanted. Funeral prices are increasing constantly and your health could alter unexpectedly as you obtain older.

It is essential to evaluate your coverage typically to guarantee you have sufficient to secure surviving member of the family. The primary recipient gets 100% of the death advantage when the insured passes away. If the key recipient passes prior to the guaranteed, the contingent receives the advantage. Tertiary beneficiaries are commonly a last option and are just utilized when the primary and contingent recipients pass prior to the insured.

It's essential to occasionally assess your recipient info to make sure it's updated. Always alert your life insurance policy company of any adjustment of address or telephone number so they can upgrade their documents. Many states enable you to pre-pay for your funeral service. Prior to you pre-pay, inspect to see how the cash will be held.

The death advantage is paid to the primary recipient once the insurance claim is accepted. It depends upon the insurance firm. The majority of people can get insurance coverage till they turn 85. There are some business that insure somebody over the age of 85, however be prepared to pay an extremely high costs.

Funeral Insurance Wa

If you do any kind of funeral preparation ahead of time, you can record your final long for your primary beneficiary and demonstrate how much of the policy benefit you intend to go towards final setups. The procedure is typically the exact same at every age. Most insurance provider require an individual go to least 30 days of age to use for life insurance policy.

Some firms can take weeks or months to pay the policy advantage. Your insurance coverage rate depends on your health, age, sex, and just how much protection you're taking out.

Tobacco prices are higher no issue what type of life insurance you take out. Last expenditure insurance coverage raises an economic problem from households regreting the loss of a person they enjoy.

Final expense insurance coverage has a survivor benefit designed to cover expenses such as a funeral or memorial solution, embalming and a casket, or cremation. However, beneficiaries can utilize the survivor benefit for any kind of purpose, from paying real estate tax to taking a getaway. "They market the last cost insurance to individuals who are older and starting to think of their funeral prices, and they make it look like they need to do it in order to look after their family members," claims Sabo.

Last cost insurance is a little entire life insurance plan that is simple to receive. The beneficiaries of a last expenditure life insurance policy can use the plan's payout to spend for a funeral service, casket or cremation, clinical costs, nursing home bills, an obituary, flowers, and a lot more. The fatality advantage can be utilized for any type of objective whatsoever.

When you use for last expense insurance policy, you will certainly not have to take care of a clinical test or allow the insurance business access your clinical documents. You will certainly have to address some health concerns. As a result of the wellness concerns, not every person will receive a plan with protection that starts on day one.

Funeral Cover

The older and less healthy and balanced you are, the greater your prices will certainly be for a provided quantity of insurance coverage. Men have a tendency to pay greater rates than females due to the fact that of their shorter average life span. And, depending on the insurance firm, you may certify for a reduced price if you do not make use of tobacco.

Depending on the plan and the insurance firm, there may be a minimum age (such as 45) and optimum age (such as 85) at which you can apply. The biggest survivor benefit you can select may be smaller sized the older you are. Policies might rise to $50,000 as long as you're younger than 55 yet just increase to $25,000 once you turn 76.

Let's say you're retired, no longer have life insurance coverage via your company, and don't have a specific life insurance coverage policy. You're thinking about a brand-new life insurance coverage policy.

Latest Posts

Life Insurance Online Instant Quotes

Final Expense Insurance For Cremation

All Life Funeral Policy