All Categories

Featured

Table of Contents

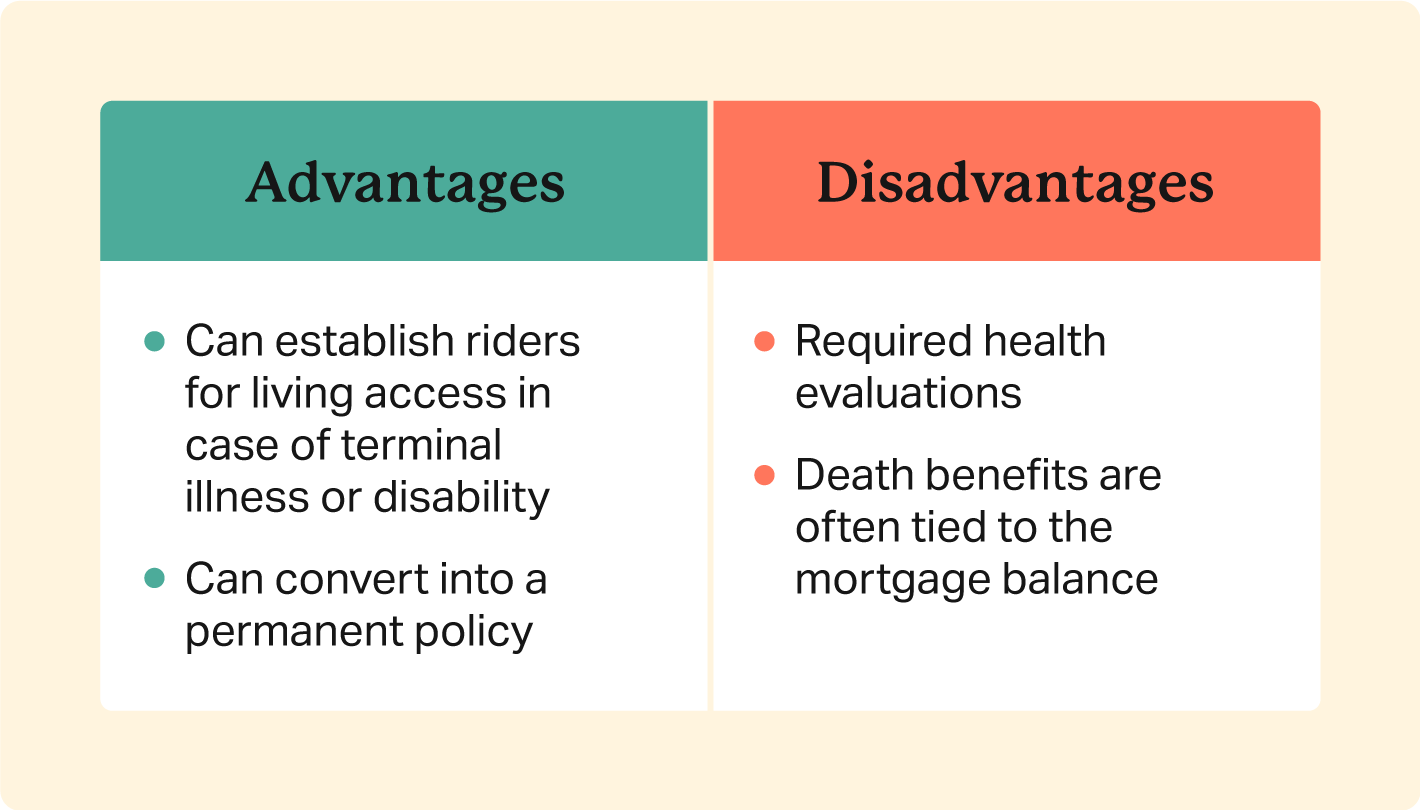

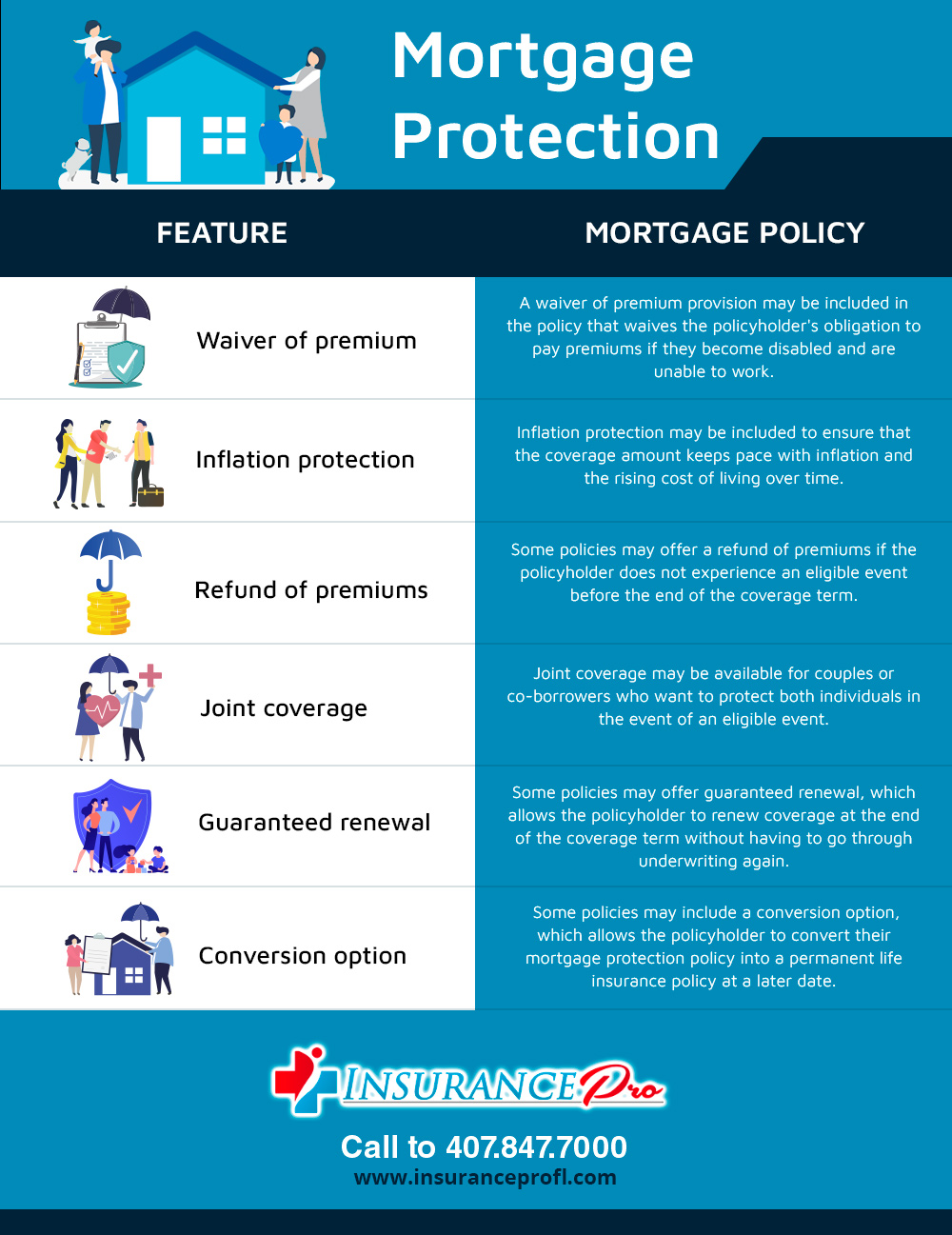

If you're healthy and have actually never ever utilized cigarette, you'll generally pay more for home loan defense insurance coverage than you would certainly for term life insurance policy (do i have to have mortgage protection insurance). Unlike other kinds of insurance policy, it's challenging to get a quote for home loan security insurance policy online - insurance that pays off your mortgage if you die. Prices for home mortgage protection insurance policy can differ widely; there is less transparency in this market and there are way too many variables to precisely compare rates

Term life is an excellent choice for home loan protection. Insurance policy holders can profit from several advantages: The quantity of coverage isn't limited to your home mortgage balance. The fatality payout remains the very same for the term of the plan. The beneficiaries can make use of the plan continues for any type of purpose. The plan supplies a survivor benefit also after the home loan is repaid.

You may want your life insurance coverage policy to safeguard even more than simply your home mortgage. You select the policy worth, so your protection can be extra or much less than your home mortgage equilibrium. You can even have greater than one policy and "pile" them for tailored coverage. By piling policies, or riders on your plan, you could reduce the life insurance policy benefit over time as your home mortgage balance reduces so you're not spending for protection you don't require.

If you're insured and die while your term life policy is still active, your chosen enjoyed one(s) can utilize the funds to pay the mortgage or for one more purpose they select. mortgage life and disability insurance cost. There are many advantages to making use of term life insurance policy to shield your home mortgage. Still, it might not be a best service for everyone

Private Mortgage Insurance Vs. Homeowners Insurance

Yes and no. Yes, due to the fact that life insurance policy policies often tend to line up with the specifics of a home mortgage. If you purchase a 250,000 house with a 25-year home loan, it makes feeling to get life insurance coverage that covers you for this much, for this long. That means if you die tomorrow, or at any type of time during the following 25 years, your mortgage can be removed.

Your family or recipients get their lump amount and they can invest it as they such as (mortgage protection policy insurance). It is essential to understand, nonetheless, that the Home mortgage Defense payout amount lowers according to your home mortgage term and balance, whereas level term life insurance policy will certainly pay out the same round figure at any moment throughout the plan size

Legal And General Mortgage Insurance

You may see that as you not getting your payment. However on the other hand, you'll be alive so It's not like spending for Netflix. You do not see a noticeable or in advance return wherefore you get. The amount you spend on life insurance policy every month doesn't repay until you're no more below.

After you're gone, your enjoyed ones don't need to stress over missing settlements or being unable to pay for living in their home (house loan protection insurance). There are two primary varieties of home mortgage security insurance policy, degree term and reducing term. It's always best to get guidance to determine the plan that best talks with your requirements, spending plan and conditions

Latest Posts

Life Insurance Online Instant Quotes

Final Expense Insurance For Cremation

All Life Funeral Policy